3 Essential Market Insights

We like to provide our subscribers with “essential market insights.”

According to Mortgage Bankers Association research,“Eight percent—$121

billion of $1.2 trillion—of outstanding commercial and multifamily

mortgages held by non-bank lenders and investors will mature in 2015.

This is a 32% increase from the $91.7 billion that matured in 2014.“ The

pending onslaught of maturities combined with an increasing appetite

across all lending segments will make for a dynamic commercial market in

2015. Here are three essential market insights you need to know about to take advantage of the evolving landscape.

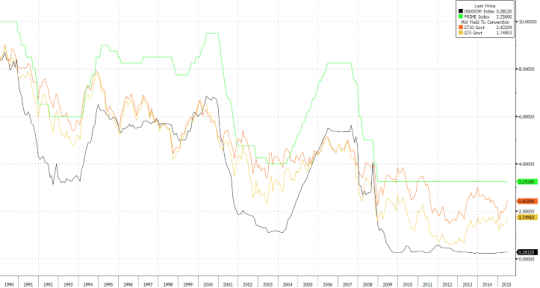

interest rates over the past 25 years

CMBS

Bond securitization are in demand right now, so it’s no surprise that the first half of 2015 has been a very active period for CMBS production. Most 10-year loans are being placed at 4.0-4.5%. Borrowers can expect higher leverage and possibly full or partial term interest only.

Life Companies

Expect fixed rate terms for up to 25 years in this segment, with interest rates on 10-year fixed currently falling between 3.5-5.0%. With interest rate yields on commercial loans 1-2% higher than alternative bond investments, insurance companies are eager to build out their portfolios.

Banks

Banks have been more aggressive than past years recently as the economy has strengthened and portfolio default rates have declined. Interest rates can vary amongst institutions, but generally focus on shorter term fixed rate bridge and construction loans.