Bond Market Bubble

Should you be concerned about the bond market bubble? In a recent post, Andrew Flowers of FiveThirtyEight-Economics discusses the reality that many of us have suspected but would rather not face: the US bond market just isn’t normal right now. Due to the Fed’s bond buying stimulus program as a portion of QE, the forward Treasury curve looks like a theory chart in a text book; it’s downright beautiful, and suggests expectations of a steadily growing economy. But things often aren’t as they seem.

Flowers explains assertions by Federal Open Market Committee member and Harvard Professor of Economics Jeremy Stein’s concerns over a bond market bubble, and it’s fair to say the idea can be a bit unsettling.

One stark illustration that supports ideas of the Fed’s influence on the bond market during QE can be witnessed in this chart. Click the animate button to compare what the curve looks like during the downturn and subsequent recovery in the early 2000s to the one of most recent memory. The curve begins to stabilize right around the beginning of QE1 (Nov 2008), slowly begins to fluctuate, stabilizes around the announcement of QE2 (Nov 2010), slowly begins to fluctuate and then stabilizes again for QE3 (Sept 2012). These fluctuation-stabilization cycles clearly seem to lend credence to Flower’s assertions of propped-up pricing. Although the bond market has been fluctuating daily, short term and long term bond yields are moving more or less together—maintaining that beautiful, possibly false shape.

Another of Flowers’ thoughts that struck me was the Corporate Bond Spreads chart included in the article, which could be interpreted to represent investors’ view of a company’s risk on the horizon and their resultant willingness to lend.

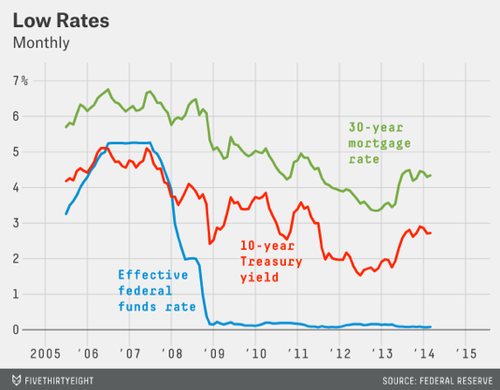

From our perspective, the current commercial mortgage landscape is one of the most borrower-friendly markets we’ve seen in a very long time. There is capital flowing everywhere and fewer properties to capture it, so competition is up. Mortgage spreads for our lenders are shrinking and rates remain at historic lows, albeit already 100bps over where they were at their lowest in Jan 2013. At the same time, while our correspondent life insurance, banks and CMBS lenders are hungry to get their cash out, we haven’t seen any real returns to the doubtful underwriting guidelines of the prior era.

We think this bodes well for the mortgage market going forward as tapering continues under Fed Chair Yellen’s leadership. Rates ought to stay low for the next 6-9 months, though the market may be slowly self-correcting now in anticipation of the end of QE. Friday’s pending jobs report may speak further to either a steadily strengthening economy or to one that is still trying to maintain purchase. Either way, normalcy is probably not expected in the long run.

Cody Charfauros is a Commercial Mortgage Banker with Barry Slatt Mortgage and resides in Sherman Oaks, California with his wife and son.