Choice of Entity: Which is Best for You?

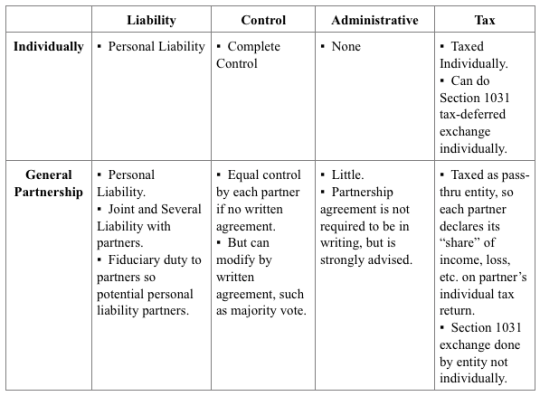

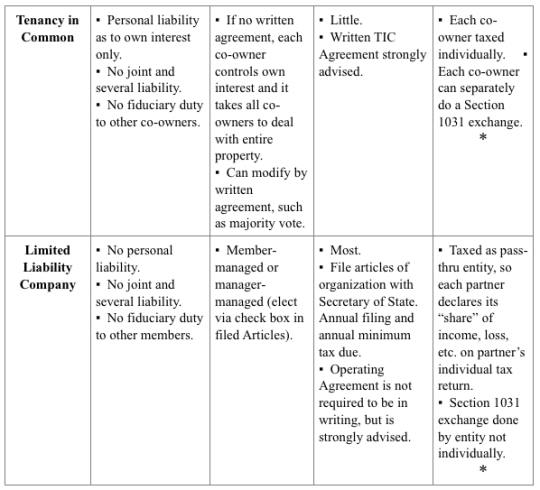

No matter the situation, just about every commercial real estate transaction involves one universal question: What is the best way to take title? Of course there is no one right answer. The choice of entity structure depends on the investor’s objectives, but we can outline what your options are, and overview their associated attributes. In this latest installment of our ongoing legal series, we’ll discuss the most common entity structures for taking title in the United States.

*NOTE: A general partnership can be inadvertently formed, without a written agreement, by the parties’ actions, verbal agreements or the way they file tax returns. Vesting of title to the property alone is not determinative of whether property is held as tenants in common. A general partnership could have inadvertently been formed by the co-owners. Checking how co-owners have the property’s income/loss on their tax returns is advised in determining entity status.

Choosing an entity structure has economic, tax and legal ramifications and should be considered with the input of an accountant and attorney’s professional advice. To fully understand the legal implications of your unique situation, please contact Lisa Stalteri, shareholder and member of the real estate group at Hopkins & Carley, one of the most competent and prestigious law firms in the Bay Area. Lisa has over 25 years of experience in commercial real estate transactions, having counseled clients in all areas of commercial property including leasing, financing, construction, and acquisitions. Click here to contact her to discuss your specific needs, or email her directly at lstalteri@hopkinscarley.com.