CRE Lending Trends in Times of Volatility: What Borrowers and Investors Need to Know

The past few weeks have ushered in a wave of volatility in the commercial real estate (CRE) finance space, driven by global market jitters over shifting tariff policies, heightened risk perceptions, and looming recession fears. While these concerns ripple through markets worldwide, they’ve hit CRE lending with particular force, leaving borrowers and investors wondering how lenders will respond. By examining historical patterns and recent shifts in CRE lending—credit spreads, capital supply, loan demand, and lender behavior—we can glean insights into where the market might be headed and what it means for stakeholders navigating today’s tariff-induced uncertainty.

Credit Spreads: A Shifting Landscape

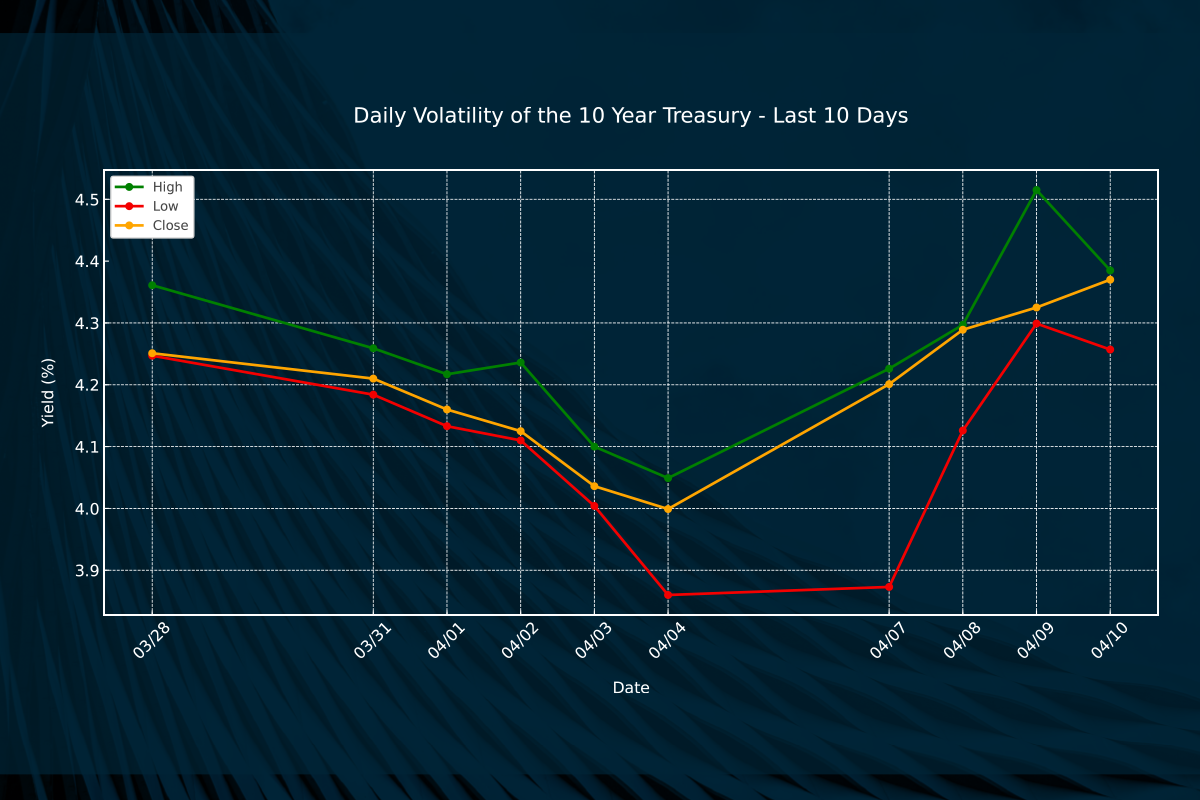

Credit spreads—the difference in yield investors demand over a benchmark like a U.S. Treasury note—offer a window into market sentiment. Traditionally, when Treasury yields rise during periods of disruption, credit spreads move inversely, narrowing as investors seek safety. Since 2022, however, this relationship has unraveled. Throughout 2023 and most of 2024, credit spreads rose alongside Treasury yields, defying the old playbook. One likely culprit? Persistent inflation fears that spooked bond investors, prompting them to demand higher returns across the board—both on Treasuries and CRE-related debt.

Fast forward to January 2025: Treasury yields began to fall, and credit spreads on corporate and CRE paper followed suit. Liquidity returned, optimism grew amid deregulation hopes, and spreads hit 30-year lows. Yet all-in coupons for CRE loans remained elevated—not due to wide spreads, but because Treasury yields stayed stubbornly high. Today, as tariff strife reintroduces volatility, this dynamic could shift again. If risk-off sentiment takes hold, expect spreads to widen as lenders and investors brace for uncertainty.

Supply of Capital: From Abundance to Adjustment

The supply of capital tells another part of the story. In 2021 and 2022, U.S. capital markets swam in liquidity, fueled by loose monetary policy, record-low borrowing costs, and stimulus cash. CRE lenders enjoyed banner years, and even as the Fed tightened in 2023, allocations remained robust, with lenders eager to deploy funds at higher yields. When rate cuts began in mid-2024, optimism persisted—surely demand would rebound. But it didn’t. CRE investors stayed sidelined, leaving capital untapped.

Entering 2025, lenders armed with fresh allocations and a renewed sense of abundance slashed spreads to drum up business. Q1 saw fierce competition for quality deals, even as maturing loans and elevated rates loomed. Now, with tariff uncertainty shaking confidence, this supply could tighten. Lenders may pull back, reassessing risk in a market that feels less predictable by the day.

Demand for Loans: A Perpetual Time-Out?

Despite ample capital and falling spreads, demand for CRE loans has lagged. After Q1’s competitive flurry, many expected Q2 2025 to signal a recovery—yet the “CRE time-out” persists. Borrowers remain cautious, perhaps waiting out tariff-related turbulence or betting on further rate declines. This mismatch—high capital supply, low loan volume—has pushed lenders to sweeten deals, but it’s unclear how long that will last if volatility deepens.

How Lenders Behave in Volatile Times

To understand where we’re headed, let’s break down how major CRE lender categories typically react to market swings like those spurred by today’s tariff strife.

- Banks and Credit Unions

Depositories like banks and credit unions lend based on their cost of capital—either paying depositors or borrowing from other institutions (e.g., the Fed) to fund loans at a profit. When base rates like Treasuries fluctuate wildly, these lenders struggle to price new business profitably. In volatile periods, they often pause or slow lending, waiting for clarity. Rate-sheet-driven banks, reliant on trading desks to parse the noise, are especially prone to this retreat. Borrowers may find these doors closing as tariff risks mount. - Life Insurance Companies

Life companies take a longer view, measured in decades rather than quarters. Short-term volatility—whether from tariffs or otherwise—rarely sways their lending goals. Backed by steady premium inflows from policies and annuities, they remain active even when others pull back, often becoming the last lenders standing in downturns. Unlike depositories, they’re less tied to cost of capital and more focused on opportunity cost—comparing CRE lending to similar-risk alternatives. In risk-off markets with thinning competition, life companies may widen spreads, capitalizing on their stability. On a recent update call with one of the largest (by volume) life co lenders in the country, one factor they were watching closely was trends from the other side of the house; if annuity sign-ups slow, their appetite for new CRE business may slow in kind. - Conduit and CMBS Lenders

Commercial Mortgage-Backed Securities (CMBS) lenders—often banks or financial firms—originate loans, pool them, and sell them to secondary markets. Diversified pools can buffer some risk, allowing originations to continue during uncertainty. But the sophisticated investors buying these securities react swiftly to broader risk-off moods, as we’re seeing with tariff fears. When they balk, CMBS originations shrink, underwriting tightens, spreads widen, or structures grow more conservative—moves that could accelerate if volatility persists. Conduits are often the first to pause or move spreads and can be a bellwether for the greater capital markets. - Debt Funds and Warehouse Lenders

Non-depository debt funds and warehouse lenders thrive on flexibility, stepping in where traditional players hesitate. In flush times, they compete aggressively, often offering higher leverage or looser terms. During volatility, though, their reliance on short-term funding (e.g., warehouse lines) makes them vulnerable. If capital markets seize up—as tariff uncertainty could trigger—spreads rise, and lending slows. For borrowers, these lenders may remain an option, but at a steeper price.

What It Means for Borrowers and Investors

So, how do lenders behave in periods like this? History and recent trends suggest a mixed bag. Depositories may clam up, waiting out the tariff storm. Life companies will likely stay the course, albeit with possibly wider spreads. CMBS and debt funds originations could slow or get pricier as secondary markets and funding lines feel the pinch. For borrowers, this means fewer options and potentially higher costs unless they lock in deals early. Investors, meanwhile, should watch credit spreads as a barometer—widening signals caution, while narrowing could hint at stabilization.

Today’s volatility, tied to tariff strife, echoes past disruptions but carries unique twists—like the broken Treasury-spread link and post-2024 rate dynamics. Lenders are adapting, but their moves hinge on how long uncertainty lingers. For now, staying nimble and informed is the best play in a market that’s anything but predictable.