Exploring the MBA’s Q1 2024 Commercial/Multifamily Mortgage Bankers Originations Survey

The Mortgage Banker Association released their quarterly survey of Commercial/Multifamily Mortgage Bankers originations for the first quarter of 2024. Key highlights include:

Steady Start to 2024:

The year began with commercial and multifamily mortgage loan originations maintaining the pace of Q1 2023, but with a 23% decline from Q4 2023.

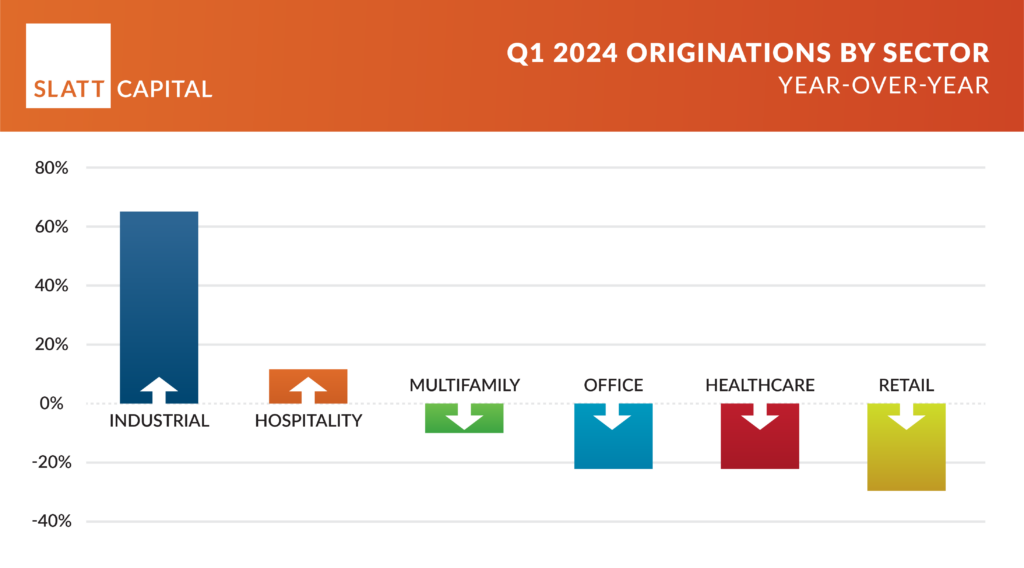

Sector-Specific Trends from Year-Over-Year Prior Quarter:

Retail properties have seen a significant 31% year-over-year decrease, while healthcare properties and office spaces also experienced declines. In contrast, industrial properties surged with a 63% increase, and hotel properties enjoyed an 8% rise. This mixed bag of results underscores the selective nature of current market activity, driven by specific sector dynamics and broader economic factors. Industrial product type continues to be highly favored by lenders. (see chart below)

Lender Type Behavior Shifts:

Depositories (Banks and Credit Unions) and GSEs loans decreased, whereas Life Insurance Company loans and investor-driven lender loans increased, with CMBS loans nearly doubling. With the banks pulling back for lending, Life Insurance Companies continue to fill this void for permanent loans. Debt Fund originations remain strong as sponsors continue to seek bridge loans and shorter-term solutions. Banks, for the most part, have exited bridge lending. While CMBS has doubled, this doubles off a poor volume Q1 2023.

In line with this trend, Slatt Capital has seen Q1 2024 Life Insurance Company originations rise from 32% to 52% of total originations year-over-year. Deals under application as well as all quoted loans tracked in Slatt Capital’s database suggest the trend will continue in Q2.

Economic Caution:

Elevated interest rates and economic uncertainty have led to a cautious market approach, with property owners opting for sales or refinances only when necessary.

Market Sentiment:

The survey by Jamie Woodwell, MBA’s Head of Commercial Real Estate Research, suggests a trend of reassessment and recalibration among market participants due to loan maturities and other factors.

For more information from the MBA, visit their news & research page here:

https://www.mba.org/news-and-research