Flex Your Investment Portfolio With Industrial Flex

I’d like to explore a dynamic asset class that boasts robust cashflow fundamentals and attracts considerable attention from lenders – “Flex” or “Flex Industrial” spaces. The versatility of flex spaces makes them highly sought after, with assets often featuring a diversity of tenants. Depending on the size and functionality of the space, one could encounter a multitude of uses. In my recent deals, I have run into the following uses by tenants:

- Retail/showroom space

- Warehouse functions

- Office spaces

- Artist studios and seamstress workshops

- Light manufacturing activities, including fabricators, cabinet makers, welding, etc

- Automotive services (autobody, window tinting, and detailing)

- HVAC repair and supply

- Fitness centers and gyms

- Showrooms for pools and hot tubs

- Unique spaces, such as a pickleball court

- Houses of worship and religious gatherings

- E-commerce fulfillment centers

Let’s delve into what doesn’t quite fit the flex criteria to provide a clearer image of a flex building. It might seem counterintuitive, but it likely does not fall under the flex category if a building distinctly exudes a singular purpose, such as a strip retail center or a medical office park. Flex buildings tend to be inconspicuous, lacking prominent signage, and often set back without excellent visibility from the roadway. Despite their unassuming presence, they overcompensate for this lack of memorability with durable investment qualities. Some general characteristics that flex buildings tend to share are some sort of door access – whether roll-up or dock-high- and the ability to accommodate some very small percentage (think sub 10%) of office space. Flex buildings also are generally “small-bay” or “shallow-bay” oriented, meaning the size and depth of the unit is smaller – this is contrasted with medium or large bay warehousing that is frequently large in square footage, accommodates one to two tenants and is distribution or “3PL” oriented.

While one might expect to find flex buildings in areas zoned for industrial and manufacturing, it’s not uncommon to discover them in infill locations where zoning might not traditionally allow for such usage. In these instances, where the use is grandfathered, proximity and scarcity become potent demand drivers.

Diving deeper into the flexibility within “flex industrial” spaces, these spaces are intentionally designed to be adaptable, allowing businesses to transition between different functions seamlessly. The ability to house a mix of uses within the same facility sets flex industrial spaces apart from more specialized structures. For example, a flex space could cater to both manufacturing processes and office functions, providing a versatile environment that can evolve with the changing needs of its occupants. Moreover, integrating advanced technologies is a defining feature of newer flex industrial spaces. These technologies enhance operational efficiency, facilitate automation, and contribute to the overall adaptability of space.

The leasing aspect of flex industrial spaces is noteworthy as well. Unlike traditional industrial leases with extended terms, flex spaces often offer shorter lease terms. This flexibility caters to businesses that may experience fluctuations in space requirements or those seeking a more agile approach to their real estate commitments. Shorter leases allow tenants to adjust their spatial needs more readily, aligning the space with their evolving business strategies. On the ownership side, however, this allows leases to be more readily adjusted to inflation and demand, driving rent growth. We recently caught up with Frank Forte, Chief Investment Officer of Lucern Capital Partners, an investment group focused on light industrial opportunities in the Southeast, for his take on small bay warehousing.

“We love the universality of our spaces, which accommodate such a diverse tenant pool. Most of our tenants are small businesses and look at their monthly rent in nominal terms, providing strong support for robust rent growth on a per-square-foot basis. With the advent and boom of large big-box warehouses, smaller tenants have been priced out and need space in infill locations to operate. Replacement cost issues have created a dearth of new supply, leading to significant scarcity and favorable supply/demand imbalances.”

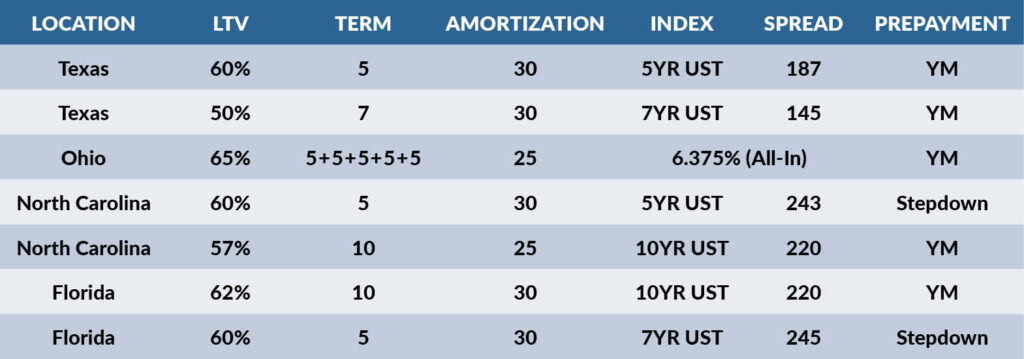

Some recent quotes for flex deals:

For more information on Lucern Capital and the deals they are working on, please contact Frank Forte directly at frank.forte@lucerncapital.com.

Please reach out for further discussion or any questions about this topic.

John Darrow

Principal

john.darrow@slatt.com