From Spring to Fall – Shifting Attitudes in Commercial Real Estate Lending | Key Insights from the Latest Slatt Capital Lender Sentiment Survey

The Slatt Capital Lender Sentiment Survey is a study designed to gauge lender perspectives on key market trends and expectations within commercial real estate finance. Sent to a wide spectrum of lender types, the survey collects and analyzes responses to inform stakeholders about evolving market dynamics.

Our most recent comparison of findings between February 2025 and September 2025, represents a pulse check of attitudes between the beginning of the current administration and the current economic and business climate. The results highlight notable shifts in sentiment regarding interest rates, competitive pressures, and sector performance, offering valuable insights into the changing landscape of lending and finance.

Lender Sentiment Survey Contrasts – February Versus September

10-Year Treasury Rate: In February, most respondents expected rates to reach between 4.25% and 4.75%. By September, the most common answers decreased 50 basis points to 3.75-4.5%.

The Analysis: This evolution may reflect ongoing signals from the Federal Reserve about continued rate cuts and the expectation that long-term rates will decline slightly.

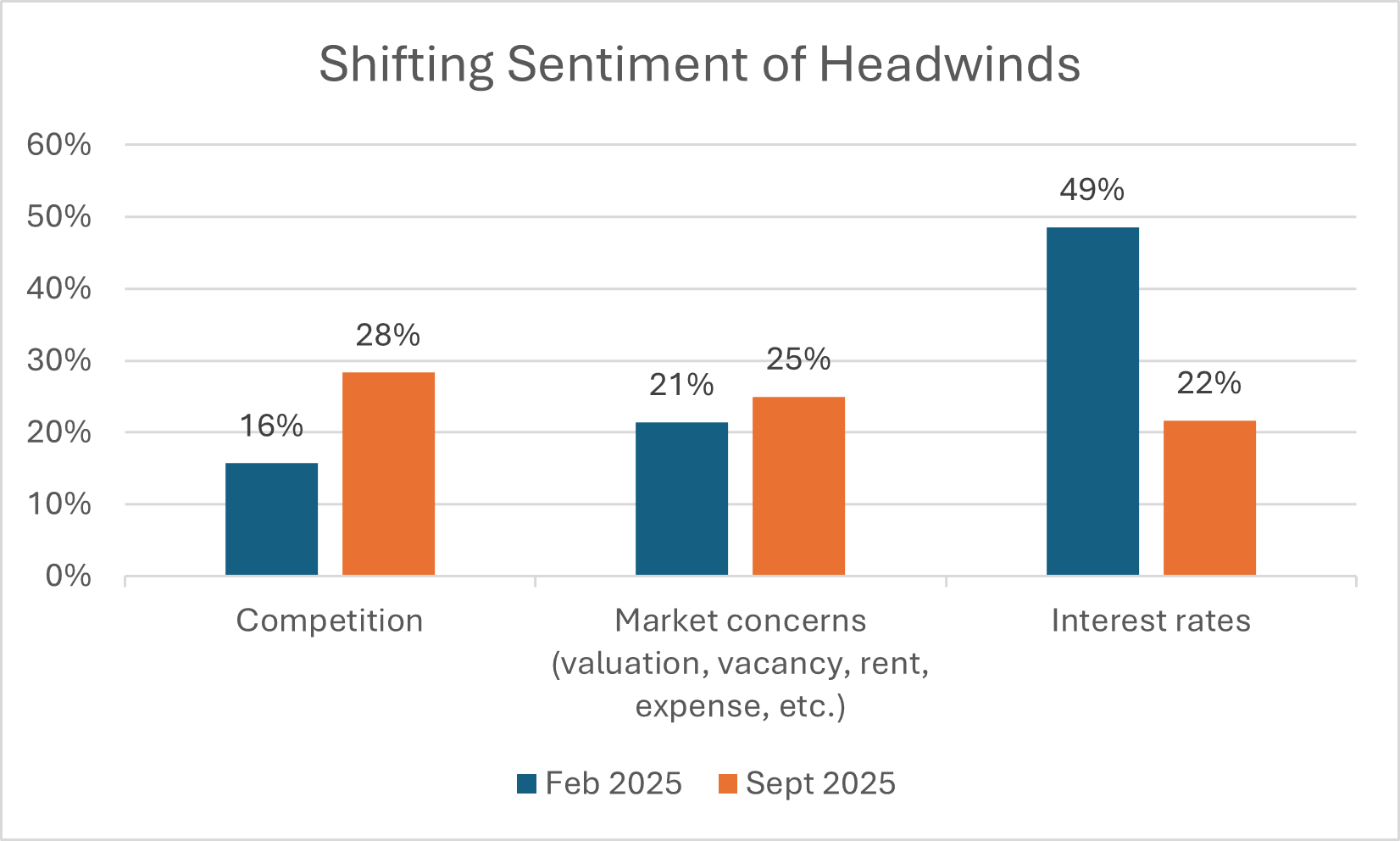

Headwinds to lending in 2025: When asked about the biggest obstacles to lending in 2025, “Interest Rates” represented the top headwind in February, while “Competition” became the most common in September.

The Analysis: This shift may be linked to the stabilizing of interest rates and a return to aggressive deal-making by both traditional and alternative lenders, who are keen to capture market share. Banks have re-entered the picture and are viewed as a more competitive market force.

Lending Allocations: Most respondents in both surveys expected lending allocations to increase and remain bullish for the second half of the year.

The Analysis: This mirrors the results of the February survey. This aligns with our observations at Slatt Capital, where activity has increased in the second half of the year compared to the first half.

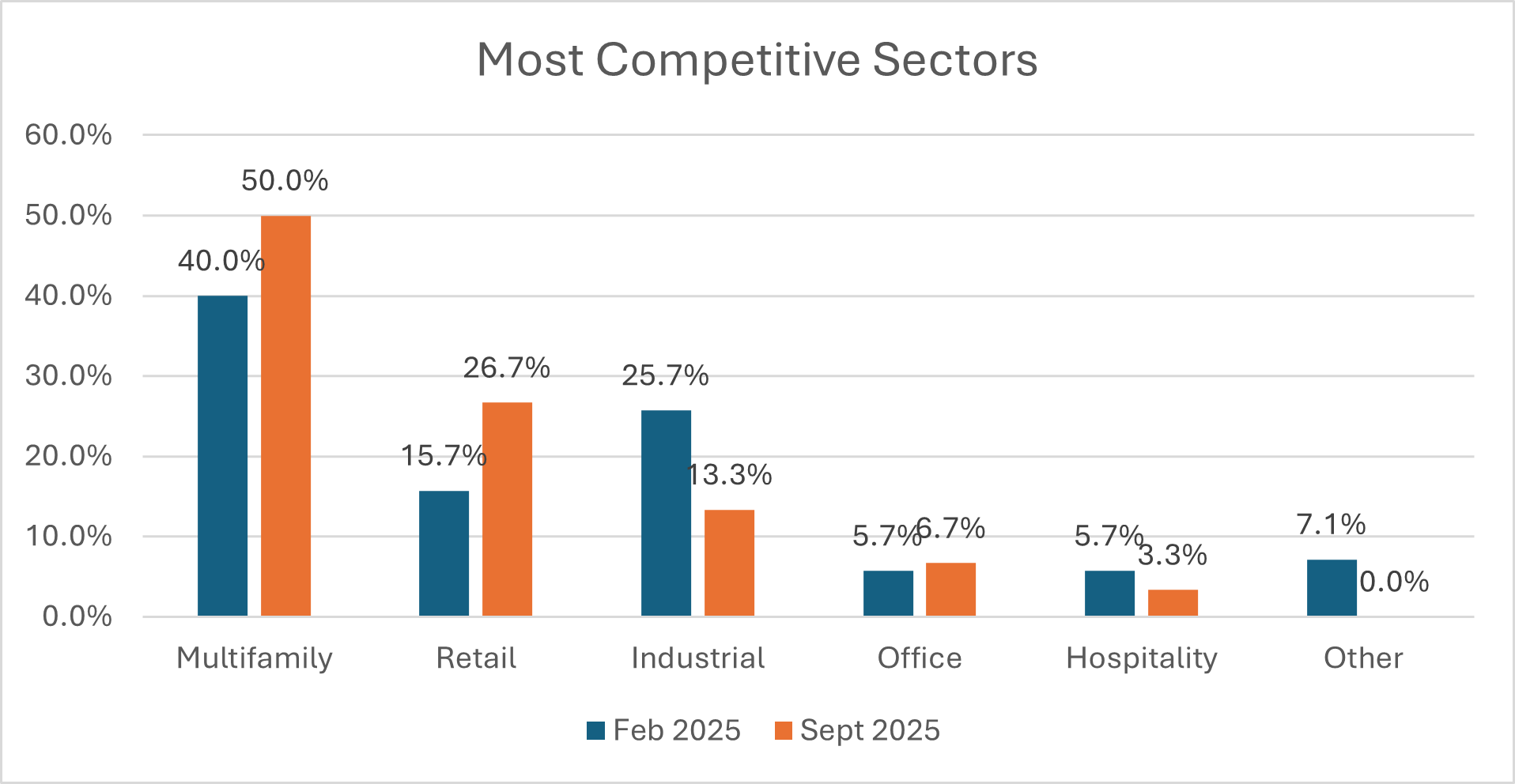

Product Competitiveness: “Multifamily” remained the most competitive commercial real estate asset type in both surveys. “Office” was consistently seen as the least competitive.

The Analysis: Multifamily was #1 by 50% of the respondents, but we saw an interesting shift in Retail coming in #2, replacing Industrial. This may be a recalibration of expectations for the industrial market, shifting due to tariffs and their associated impact on demand, as well as lenders increasingly looking to Retail, which has strong market dynamics.

Bridge Volume: Most expected an increase or no change in bridge volume, with more uncertainty (“I don’t know”) in September.

The Analysis: Lenders are less bullish or uncertain on Bridge lending volume. This could be attributed to banks re-entering the market, creating more competition for private lenders who focus more on bridge or shorter-term lending.

Financing Sectors: “Debt Funds / Private Lenders” led in February for expected finance volume increases, but “Banks and Credit Unions” took the lead in September.

The Analysis: In February, debt funds and private lenders were viewed as most likely to increase their financing activity, more than twice that of banks and credit unions. By September, banks and credit unions had taken the lead, with 33% compared to 26% for debt funds/private lenders, signaling a strategic shift as these depositories sought to reassert themselves in the commercial real estate lending space.

Despite some shifting sentiments, overall, these findings suggest a generally optimistic outlook for lending growth through the remainder of 2025, while competitive pressures and market risks remain central challenges. The lending landscape is highly dynamic, and Slatt Capital will continue to closely monitor these trends and keep our clients informed with the latest insights.

You can download a complete copy of our report here: Lender Sentiment Survey