Interest Rate Update Q1-2021

March 2021 Fed update on treasury yield

On Wednesday, March 17, 2021, Federal Reserve Chairman Jerome Powell announced that the Fed would keep its Fed Fund interest rate near zero to continue supporting the economic recovery from the Coronavirus pandemic. The Fed also indicated that an interest rate hike is “unlikely through 2023”. This accommodative stance is a continued effort by the Fed to keep interest rates low.

What is the 10 year treasury?

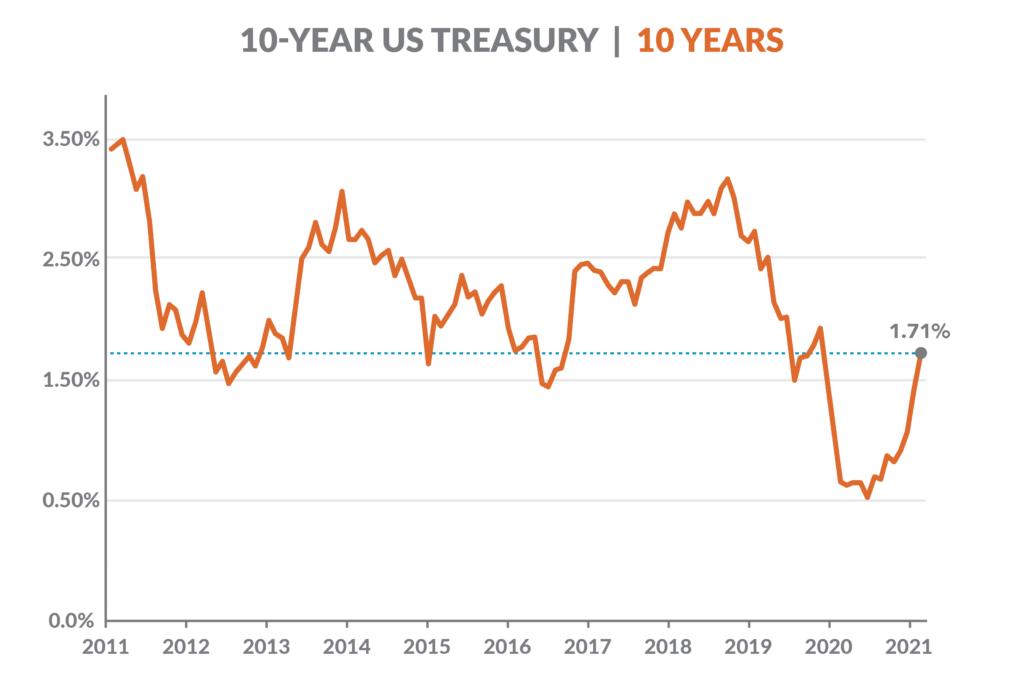

The 10-year Treasury (US10Y) closed today at 1.71%. A historic all-time low for the US10Y of .318% was hit on March 8, 2020. 30 days ago, the US10Y closed at 1.30% and a year ago at 1.069%.

Even though the “benchmark” 10-year Treasury has risen substantially over the past year, it is still very low from a historic perspective. Additionally, spreads which are the profit margin over the benchmark index that lenders use to price deals have come down. Interest rates that borrowers receive are generally the combination of a comparable Treasury yield (3, 5, 7, or 10 years) plus a spread.

It is also interesting to point out that shorter-term Treasury rates have not moved much in relation to the 10-year rate. Over the past year, the 5-year Treasury has only moved from 0.79% to its close today of 0.86%. The 3-year Treasury has come down over the past year from 0.66% to its close today at 0.33%.

The current market for typical fixed-rate loans:

3-year fixed-rate loans from 2.50-3.50%

5-year fixed-rate loans from 2.75-4.00%

10-year fixed-rate loans from 2.90-4.25%

Check back regularly for regular interest rate updates by Slatt Capital