Interest Rate Update Q2 2021

Following the conclusion of its two-day meeting on Wednesday, the Federal Reserve Board announced, “Inflation has risen, largely reflecting transitory factors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.” The continued position of the Fed to be accommodative is keeping interest rates at all-time lows.

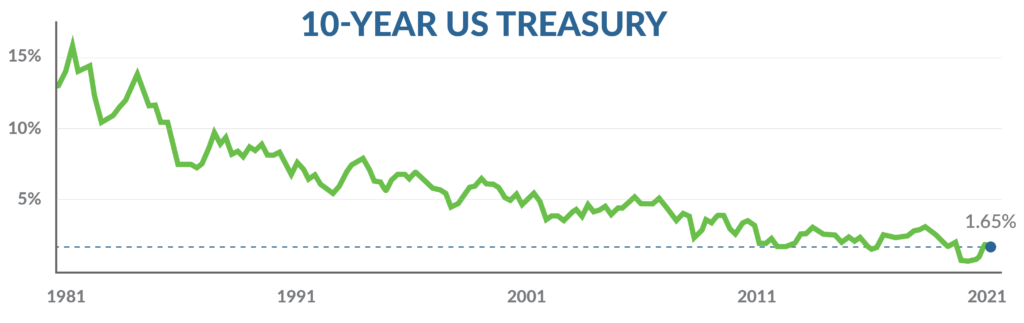

The benchmark 10-year Treasury bond closed today at 1.65%, still very low from a historical standpoint. Additionally, spreads —the profit margins over the benchmark index that lenders use to price deals, have continued to tighten this year. This reflects the perception in the market of reduced risk in lending and a rising amount of liquidity.

The current market for typical fixed-rate loans:

- 3-year fixed-rate loans from 2.25-3.50%

- 5-year fixed-rate loans from 2.50-4.00%

- 10-year fixed-rate loans from 2.75-4.25%

It is interesting to view the “benchmark” 10-year treasury bond from a historical perspective. The chart below shows the 10-year treasury rate over the past 40 years, from 1981 to the present.