Interest Rate Update | May 2023

On May 3rd, 2023, Jerome Powell announced another quarter point increase in the Federal Funds rate. However, many prognosticators speculate that this increase may be the last in this cycle.

Over the past 90 days, inflation has eased, but although the economy is not officially in a recession, there are numerous indicators of a weakening economy. One such sign that has affected the commercial real estate finance sector is the FDIC’s takeover of First Republic Bank, Signature Bank, and Silicon Valley Bank. Regional banks, as a whole, have been significantly impacted by the Fed rate hikes. According to an article by Rita Nazareth on Bloomberg.com, “Smaller lenders are under pressure after a year of rate hikes hammered the value of their bond holdings and drove unrealized losses to an estimated US$1.84 trillion.”

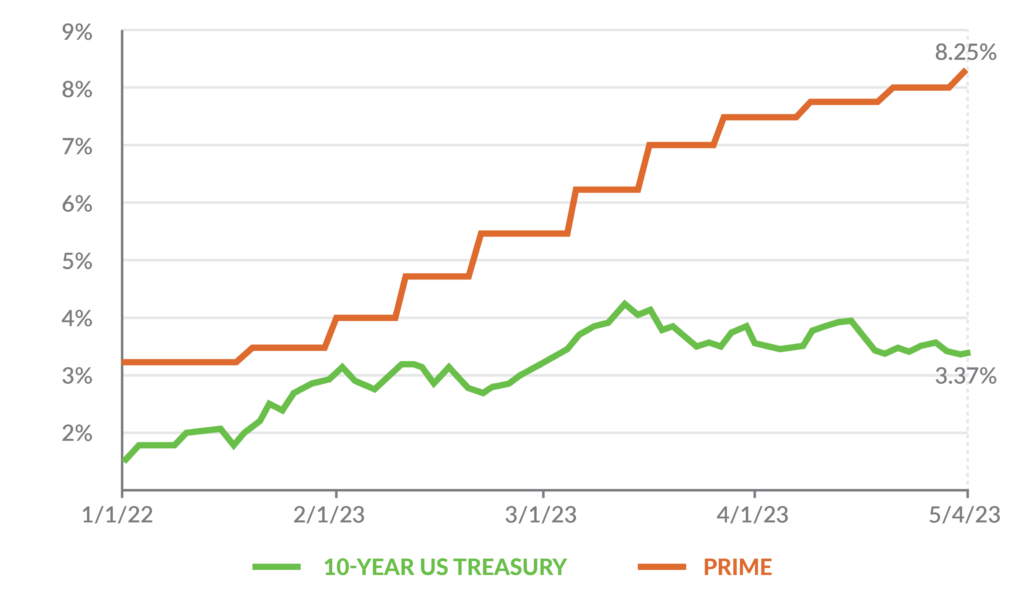

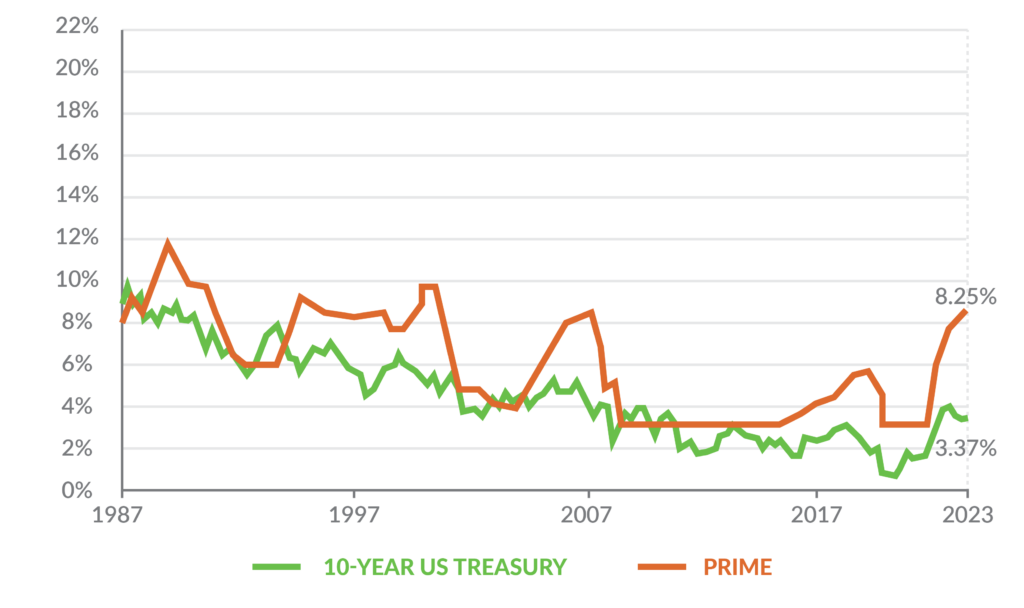

The softening economy and recent lower inflation statistics have led to a moderation of Treasury rates. The charts below illustrate the relationship between Prime and the 10-Year Treasury (US10Y) since January 2022 and over the last 40 years respectively.

In the current market for fixed-rate loans, the following rates are available:

- 3-year fixed from 5.25% to 6.25%

- 5-year fixed from 5.00% to 6.25%

- 10-year fixed from 5.00% to 6.25%