Loan Servicing & Loan Performance

Slatt Capital thought we would share our insights about servicing related requests across our $4.3B portfolio that have come in as a consequence of COVID-19.

The busiest time for our loan servicing department is during the period of March through May when servicers collect and process financial data and inspections. This normal schedule was thrown out the window in mid-March when the COVID-19 crisis required most of Slatt Capital to begin working remotely. Soon after, COVID-19-related requests began flooding in.

The Mortgage Bankers Association (MBA) acted quickly to come up with a survey to track both loan performance and COVID-related requests. The first survey was released at the end of April and a follow-up survey was released earlier this week. Our key takeaways from this survey are:

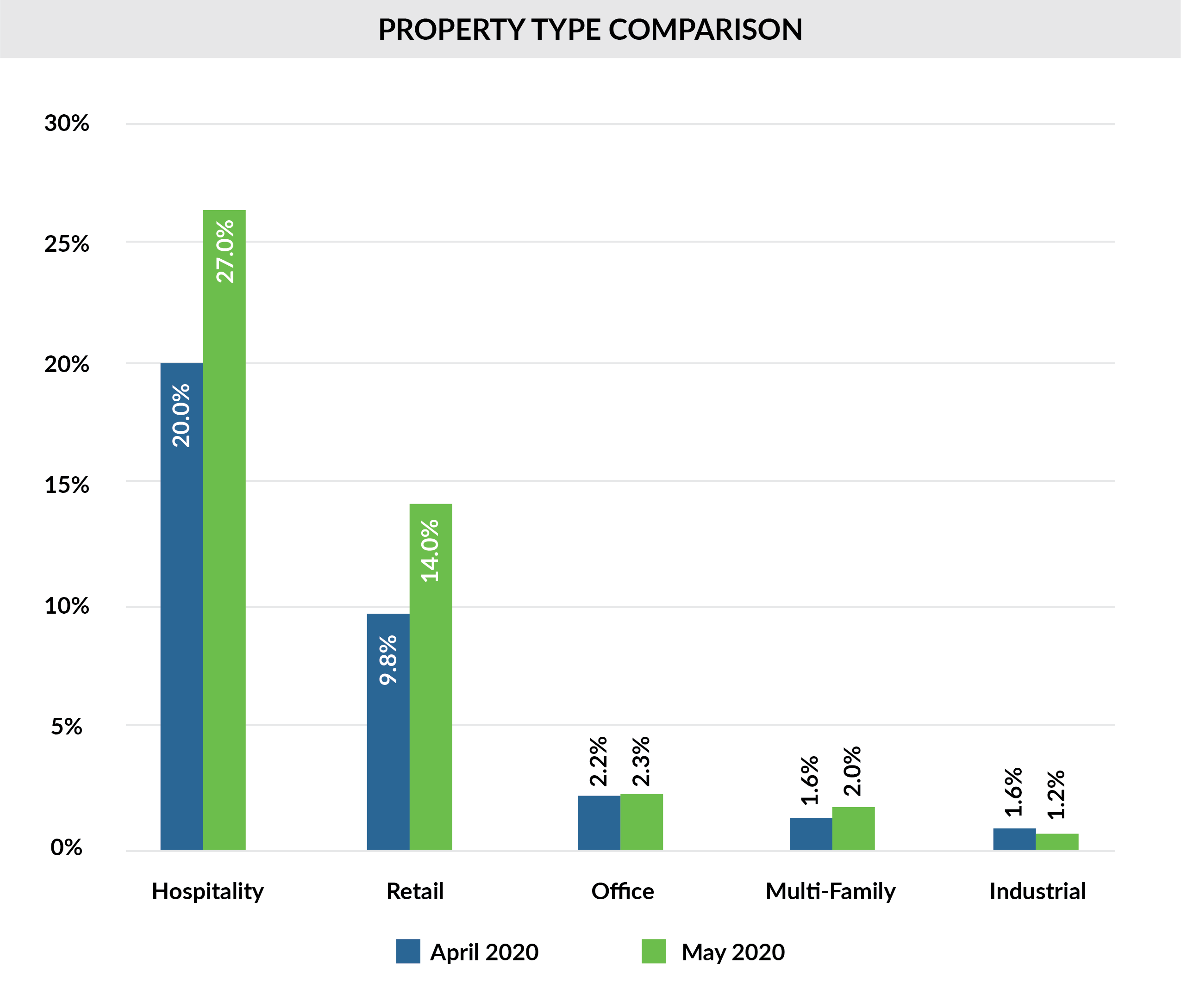

1) Lodging and Retail product types have been impacted the most. Office, Multi-Family, and Industrial are still performing well.

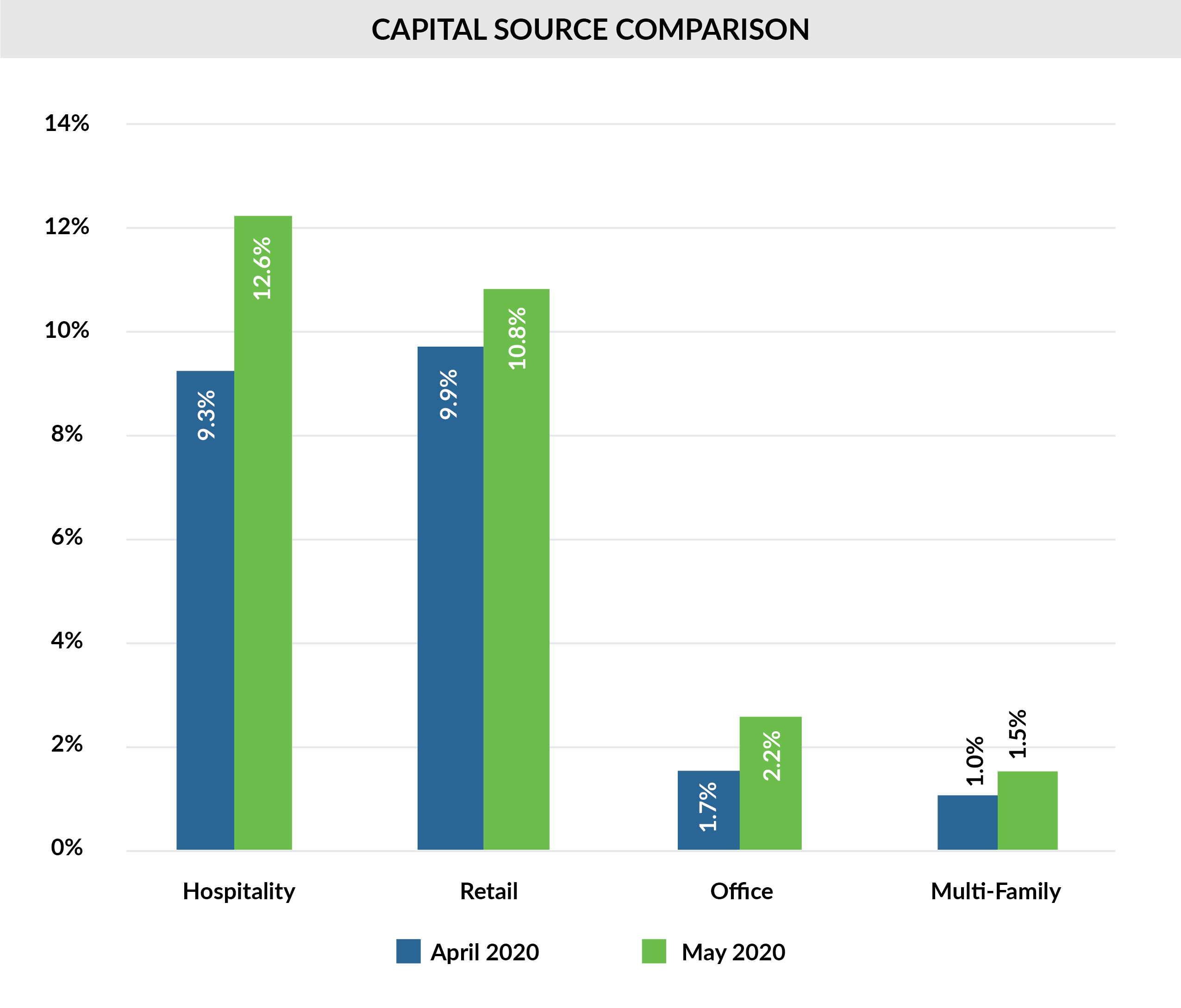

2) CMBS capital sources have had the most delinquencies while other capital sources have performed better.

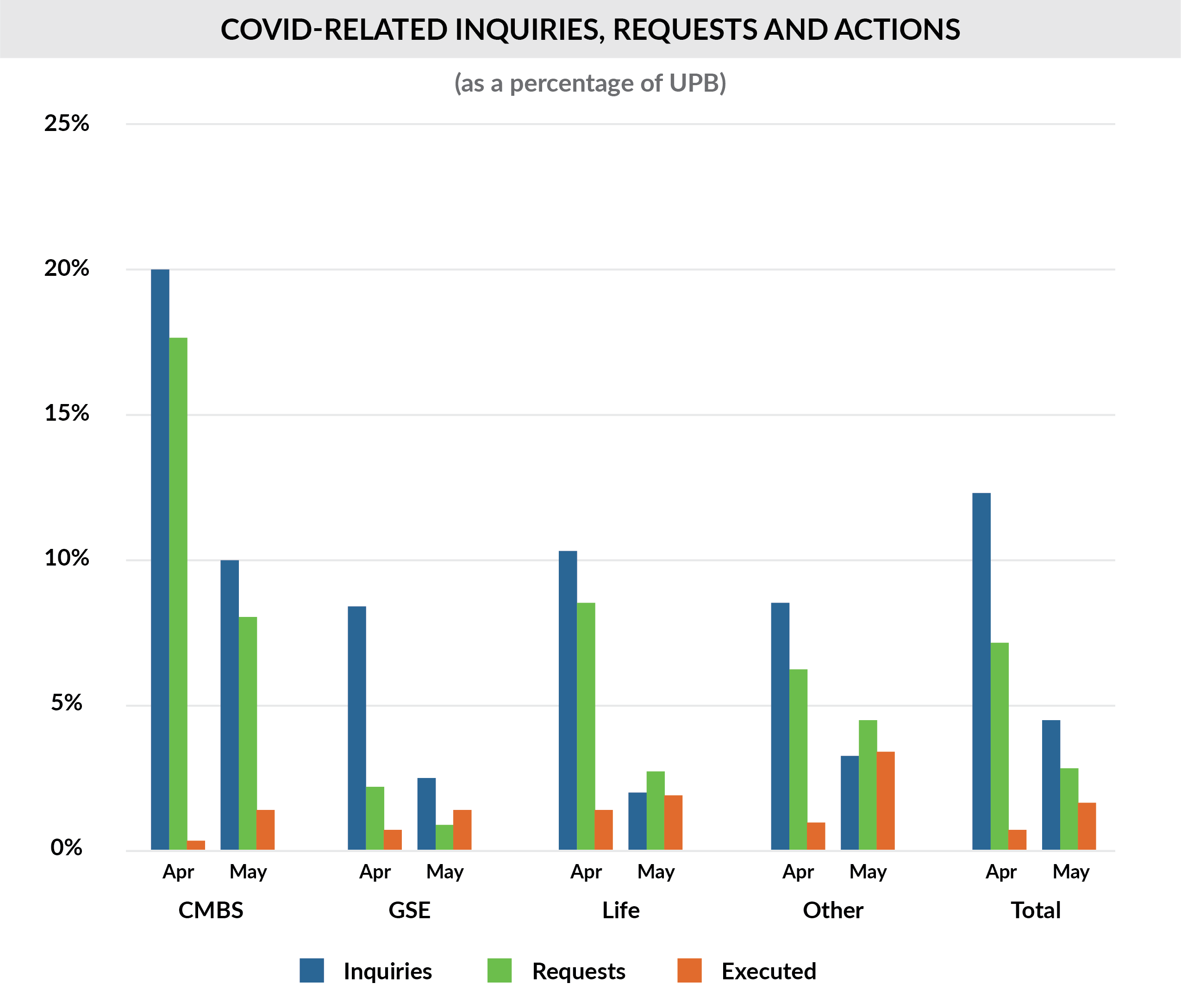

3) COVID-19 inquires and requests fell in May, so servicers were able to process twice as many requests compared to the month prior.

While our portfolio is different than that of the overall MBA survey, our experience at Slatt Capital is very similar.

- New COVID-related requests dropped 90% in May vs April.

- A large percentage of the COVID inquiries in April were borrowers wanting to have a dialogue with our servicing team vs asking for a specific lender request.

- The percentage of outstanding COVID requests not processed dropped to 37% in May from 67% in April. This reflects our lenders ramping up their ability to process these requests, as well as borrowers completing the required documentation.

- 75% of our approved COVID requests were for lodging and retail properties.

- Insurance Companies have been very responsive to borrowers with COVID requests. The MBA survey backs this up, showing that Insurance Companies (our largest correspondent source) had the highest percentage of executed requests relative to inquires in May. CMBS had the highest percentage of inquiries but the lowest percentage of executed requests in May.

We are proud of our servicing team and their ability to quickly pivot to working from home while continuing to provide the same high-touch service to our borrowers and lenders. This is a unique benefit for our borrowers, who are able to work with local servicing professionals who they can talk to and build a relationship with, and who knows their properties. Life-of-loan service is often unappreciated but becomes very valuable when you need it.

As we all reflect on the COVID-19 crisis and the associated impact on our healthcare system and economy, we remain positive and see hopeful signs that things are improving. Our insight from our servicing perspective has shown that requests are down dramatically since April, our servicing team and lenders are going back to routine work, and we are back to being 100% current on all of the loans in our portfolio.

Jason Berry

Chief Operating Officer