Looming Loan Maturities

There is a looming storm of loan maturities on the horizon. The seeds of which were sown ten years ago, when it was easy to get a loan; perhaps too easy. Ever-rising property values combined with low interest rates and loose underwriting standards created an unsustainable spate of CMBS originations. Now, all of those loans originated before the Great Recession are approaching maturity, but in a very different refinancing environment. Cue the ominous clouds and distant rumbling of thunder. That so-called spate of originations combined with the current landscape could coalesce into something scary for commercial borrowers.

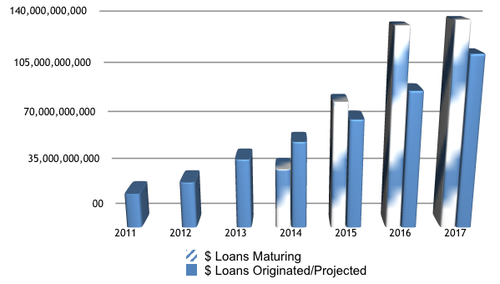

If your loan matures in the next four years, you’re not alone. Almost 35,000 fixed rate conduit loans will be maturing through 2017. That equates to over $400 billion of outstanding debt. While many borrowers have been focused on whether interest rates will remain low long enough to refinance at maturity without incurring the cost of defeasance or prepayment fees, they may not have considered whether the lending community will have the capacity for the looming wave of maturities—especially in a rising interest rate environment with more conservative underwriting.

CMBS originations have steadily increased over the past three years, with annual volumes of $24B, $32B, and $48B, respectively since 2011. Given new risk retention rules, the fragile economic recovery, and the collective desire to avoid a repeat of 2007 and the ensuing recession, a more gradual, sustainable expansion of new loan volume seems more likely. Assuming a 25% annual increase from 2014 – 2017, the projected new loan volume wouldn’t come close to satisfying the demand for new loans spurred by corresponding maturities in 2015, 2016, and 2017.

Note however, that a 25% increase in CMBS lending capacity in 2014 over 2013 actually exceeds 2014 maturities, creating lending capacity in 2014 to refinance loans maturing in 2015, 2016, and 2017. A savvy borrower will factor that into the decision about when to pull the trigger on refinancing.

While many borrowers have a negative reaction to the cost to pre-fund future interest due on an existing loan through a defeasance transaction, when used strategically to take advantage of currently available financing options, defeasance can be a valuable tool to protect real estate assets from future risk and uncertainty. The cost pales in comparison to the cost of defaulting on the loan at maturity, and navigating through the complex process of restructuring or extending your loan because capital became too scarce or a rise in interest rates put the new loan out of the money.

Many signs—tighter lending standards, rising interest rates, the phasing out of funding sources like Fannie Mae and Freddie Mac, Dodd Frank and new lender risk retention rules—point to an increasingly risky and uncertain refinancing landscape for borrowers from 2015-2017. Factor in the torrent of demand from maturing loans, and the lending environment could quickly turn against borrowers; even those with stable, performing properties today. With a finite amount of money to lend terms, rates, and spreads will be dictated by lenders, causing those numbers to rise and leaving many borrowers scrambling to pay off their loans. And don’t forget how quickly CMBS lenders can close-up shop if aggressively underwritten 2005-2007 vintage loans cannot be refinanced, resulting in short sales, declining real estate values, and a new recession. We don’t mean to dampen the tide of optimism in the market, but we’re not completely out of the woods just yet.

If you have a loan maturing in 2014, you should already be talking to your mortgage banker. If you have a loan maturing 2015-2017, you are now aware of the massive number of maturities on the horizon. Take action—discuss new loan terms, get an updated defeasance cost estimate, and understand your refinancing options. Now stress all of the variables against the potential scenario described above, compare the two and determine how much risk you are willing to take and for what gain, if any.

To get a fuller understanding of how defeasance is relevant to your bottom line contact Josh Cohen, Managing Director at Commercial Defeasance, one of the most competent and prestigious defeasance firms on the west coast. Contact Josh here directly to discuss your specific scenario.