Q4 2020 Lender Segment Market Update

In an effort to keep our customers up to date with current market trends, the following is a Q4 update for each sector of the lending market.

Insurance Companies

As we advance through the 4th quarter of 2020, most insurance companies are actively closing loans. This trend will continue through year-end and into the first quarter of 2021. When the COVID-19 driven market volatility hit in March, most insurance companies paused their lending programs. Their pause created an accumulation of uninvested cash. The unintended consequence is they now have extra capital to lend. This has also helped to keep interest rates at all-time lows. Current pricing on typical 10-year insurance company debt averages between 2.25–4.00%.

Banks/Credit Unions

For rates at the low end of the range, lenders are looking for lower leverage high-quality assets in infill locations. Most banks are still actively lending, although they are using much more conservative underwriting requirements. Construction and bridge bank loans are much harder to come by than loans on stabilized properties; however, both are still getting done. This market remains fluid but selective. The market for bank and credit union financing is quite liquid overall for a recessionary environment.

Agencies

Freddie Mac and Fannie Mae have been lending throughout this COVID-19 pandemic and continue to do so. As government-sponsored entities, they have helped keep the multi-family finance markets exceptionally liquid during this time. Agency debt involves requiring principal and interest reserves, tax and insurance reserves, and replacement reserves for many loans. Interest rates in this sector are very aggressive and typically land in the 2.10%–3.50% range.

CMBS

The CMBS market was stalled out for several weeks in March and April because the market to securitize loans was shut down in early March.

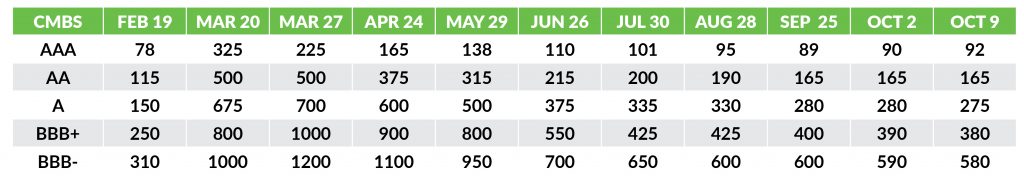

The CMBS market has made a resurgence since briefly stalling at the beginning of the COVID-19 pandemic. CMBS lenders are actively originating new loans and the securitization market has become very liquid with Federal Government stepping in to purchase CMBS and other fixed-income debt. The Fed’s action to liquify the market started in April. The chart below, provided by Morgan Stanley, shows how the different tranches of CMBS debt have priced from mid-February until October 9th. New CMBS loans are currently pricing in the 2.25-4.0% range. Leverage of up to 75% is currently available.