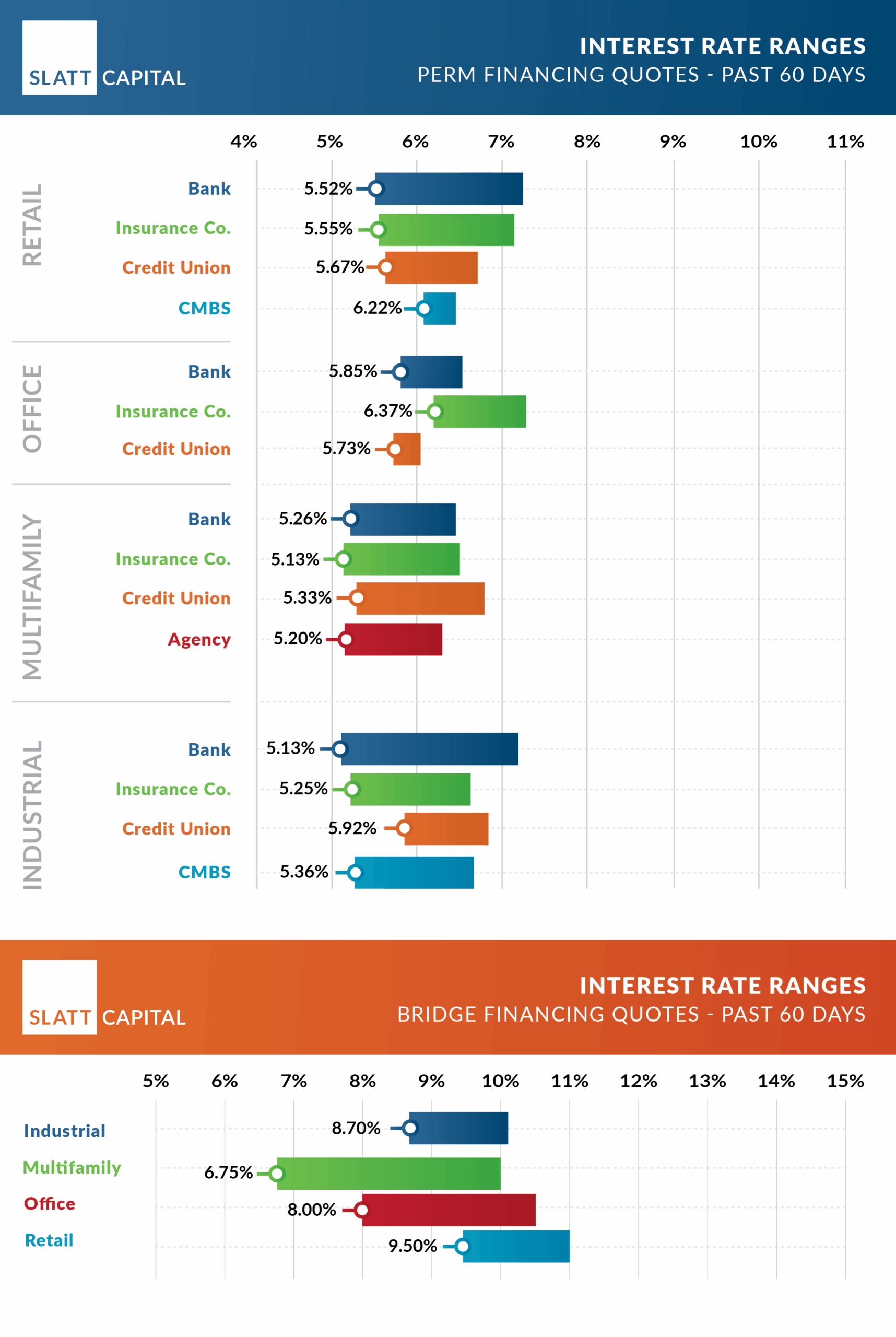

September 2025 Interest Rate Ranges: Quoted Past 60 Days

September 18, 2025 |

by Cody Charfauros, Principal and Managing Director

The last 60 days have seen permanent loan spreads across banks, life companies, and CMBS lenders stabilize near record lows with little additional compression, while U.S. Treasury–indexed interest rates have fallen in lockstep with the market’s expectations for interest-rate cuts by the FOMC. Industrial and multifamily spreads lead the pack, with retail assets close behind. We expect spreads to move higher for some lenders as they hit their year-end allocations.

As confirmed by yesterday’s 25 bps cut—and with the hope that at least another 50 bps of cuts will occur by year-end—short-term Treasuries may have some room to run, with 3- and 5-year coupons likely to compress another 15–40 bps on average by year-end, with much lower compression, if any, expected on the long-term rates for 10 years and beyond.

On the bridge side, capital remains highly available for best-in-class loan requests, though all-in coupons have barely moved over the last 60 days. We expect the ongoing cuts to further compress those coupons, though, as with permanent requests, some spreads may widen toward the end of the year.

Previous Average Interest Rate Quotes:

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

February 2025

January 2025

December 2024

November 2024

October 2024

September 2024

August 2024

July 2024

June 2024

May 2024