Slatt Capital Closes $636M in First Half of 2025, Fueled by Multifamily, Retail, and Industrial Strength

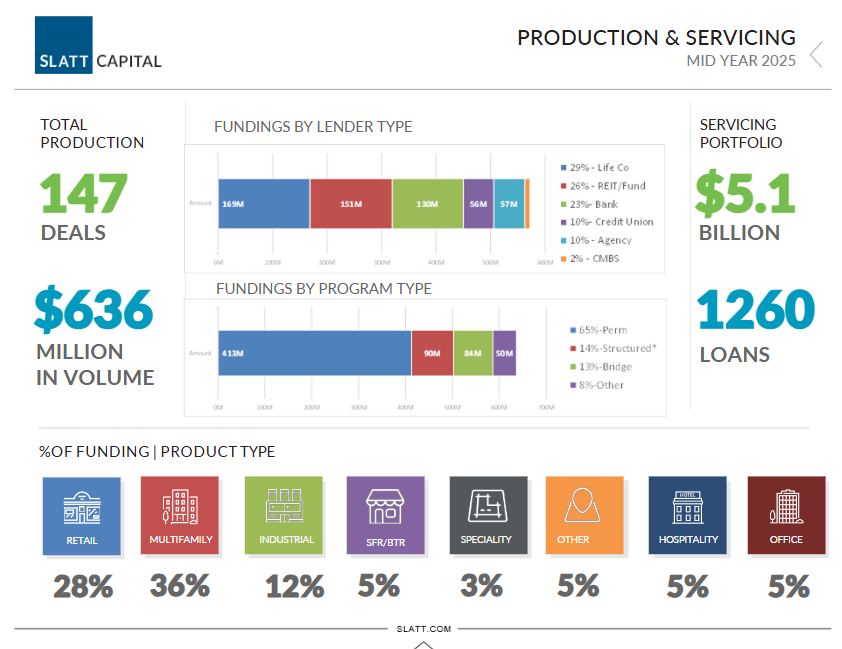

Slatt Capital entered 2025 with strong momentum, closing 147 transactions totaling over $636 million during the first half of the year. The activity reflects the firm’s continued leadership in multifamily, retail, and industrial financing, which together accounted for more than two-thirds of total deal volume.

Multifamily Leads with $207M in Deal Volume

Despite pockets of softness in certain markets, housing demand remains strong—and lenders are still backing it. Slatt arranged over $207 million in multifamily financing during H1 2025, leading all asset classes by total dollar amount.

One highlight: a $27.5 million refinance of a 270-unit community in Texas, reflecting the firm’s ability to align financing with housing needs in both high-growth and supply-constrained markets.

Retail Dominates in Volume, Closing $162M+

Retail continues to prove resilient, especially for grocery-anchored and necessity-driven assets. Slatt arranged more than $162 million in retail financing, making it the top sector by number of transactions.

Key deals included:

- A $19.7M refinance for a grocery-anchored shopping center in San Jose, CA

- A $13M acquisition of a multi-tenant retail center in Auburn, CA

The firm handled a diverse mix of acquisition, refinance, construction, and bridge loans across the retail space.

Industrial: $66M+ in High-Demand Logistics and Flex Assets

Industrial financing made up over $66 million in midyear closings. From cold storage to flex and logistics, investor demand remained high.

Notable transactions included:

- A $14.3M construction loan for a 97,000-square-foot flex facility in Oregon

- A $6.6M construction loan for a multi-tenant industrial property in Texas

- A $7.5M refinance on a 123,000-square-foot center in California

Additional Activity in Office, Hospitality, and Mixed-Use

While multifamily, retail, and industrial led the charge, Slatt also closed meaningful transactions in other asset types:

- Hospitality: $30.4 million

- Office: $29.2 million

- Mixed-Use: $22.2 million

These included branded hotel development and energy-efficient multifamily retrofits.

A Broad Lending Base in a Shifting Market

In terms of lender composition, Slatt’s deals were backed by:

- Banks & Credit Unions: 33%

- Life Insurance Companies: 29%

- REITs & Funds: 26%

- Agency Lending: 10%

- CMBS: 2%

“As market cycles shift, the need for nuanced, relationship-driven capital solutions grows stronger,” said Michael Kaplan, President of Slatt Capital. “Our midyear track record shows that sponsors trust Slatt to structure competitive, tailored financing across the capital stack.”