Yes, Rates Remain Very Low; They Could Be Lower…

Lots of digital ink is spilled nowadays on what the Federal Reserve may do with interest rates.

Historically, the Fed Funds target at 0% is of course an all-time low, and the corresponding “risk-free” 10-year US Treasury Constant Maturity bottomed out near 0.50% in early August. This has directly translated into some of the lowest costs of borrowing in the history of modern commercial borrowing, with some multifamily and industrial 10-year fixed rates in the mid to upper 2s and some even dipping below 2%.

At the most basic level, commercial real estate interest rates are made up of two components:

- The amount of interest charged on a “risk-free” investment such as the yield on a 10-year US Treasury bond (we call this the rate index), plus…

- The amount of additional interest (margin or spread) demanded by a lender to take on the perceived additional risk of investing in a commercial real estate loan instead of that risk-free investment.

For example, a recent quote we received on a 10-year loan for an industrial property was the 10yr UST yield + a margin of 2.35%, for an all-in rate of 3.15%.

So, yes, rates are historically low. But could they be lower? We’re here to say… maybe.

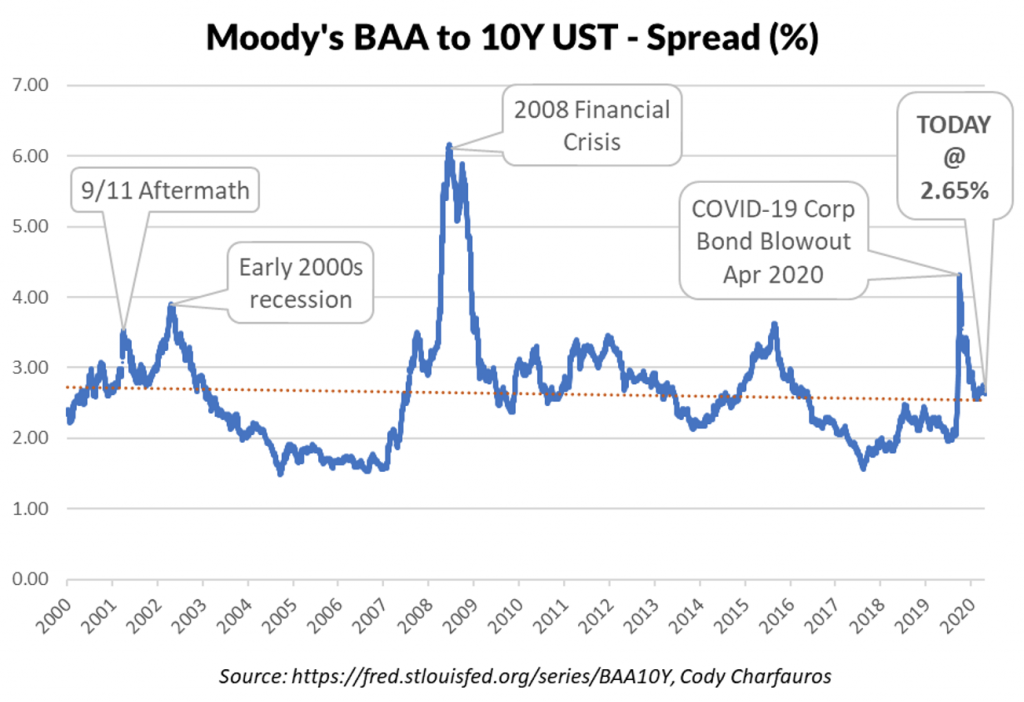

Take a look at this chart:

This is a plot of the spread between a “risk-free” 10yr US Treasury bond yield and an investment-grade corporate bond over the last two decades. This spread is the measure of additional yield an investor demands to take on the perceived additional risk of lending instead to a typical investment-grade corporation. The chart also highlights some key time periods of uncertainty and the corresponding peaking of the corporate bond spread.

Now, if you pay attention to the orange trendline that shows the average spread over time (2.63% by the way), you will notice that there are long periods where the spread dips below the trendline. What does this mean? It means that while right now, today, bond investors are issuing bonds right at the historical average spread, that spread could fall and still be within the range of reasonable. In fact, in the run up to the 2008 financial crisis the spread fell below 2%. That was probably reflective of the confidence back then that the economy could only improve from the previous recession, an attitude you see frequently right now.

So, if a) the Fed continues to keep rates at near-zero in the foreseeable future (as they’ve promised), and b) institutional investors start to see upside coming, and c) demand drives the corporate bond spread even lower, then real interest rates on loans secured by commercial real estate that average in the very low 2s or even lower could be in our future. And, in the face of the recent increase of US Treasury bond yields (which some would say a sign that the market sees growth coming), real CRE rates could also stay low.

Cody Charfauros

Principal / Managing Director

D: 858.257.2110

codyc@slatt.com

Connect on Linkedin Here