Interest Rates and LTV: Past 30 Days

July 2, 2020

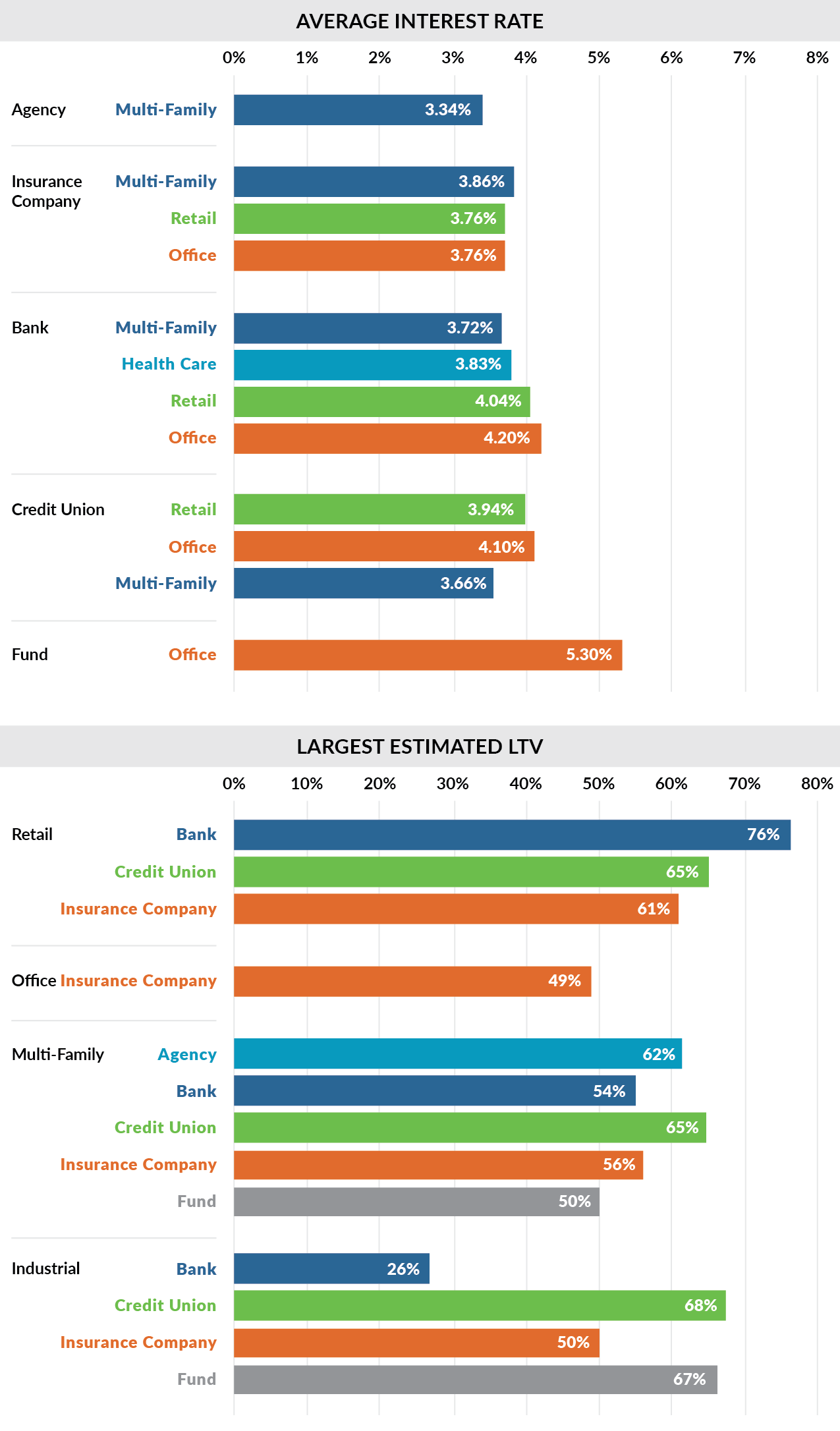

Slatt Capital would like to transparently provide a summary of Average Interest Rates and Loan-To-Value (LTV) ratios across the different property and lender types. This information is based on financing quotes received in the last 30 days, across all Slatt Capital offices:

- Multi-Family and Healthcare properties are achieving the best pricing on rates. Retail and Office are still receiving competitive pricing but generally 50-70bps higher than more sought-after lender property types.

- Best pricing is also available on Industrial properties (both single and multi-tenant), but recent loan requests have been focused on Retail, Office, and Multi-Family properties.

- The most competitive pricing has been from Insurance Companies, followed by Banks, Credit Unions, then the Private/Fund market. Agency lenders have pricing on-par with Insurance Companies and Banks but are solely focused on Multi-Family properties.

- Lender underwriting has become more conservative but leverage requests up to 65-70% LTV is still achievable. We expect this to hold or even increase as CMBS lenders return to the market.