“The Melting Cube Effect” – How to Avoid Equity Loss in Net Lease Investments

Single-tenant net lease properties remain a very popular investment vehicle, even during tumultuous times when transactions on other property types remain on the sidelines. Many investors understand the location, tenant strength, and lease term are important when assessing new properties, but many do not understand the duration of their mortgage should be an equally important factor in their investment strategy. Selecting the right loan term structure can help mitigate interest rate risk and avoid potential loss of equity.

Owners can easily find themselves in unfavorable refinancing scenarios when their loan maturity date is fast approaching and too little time remains on the tenant’s lease term. One of the biggest questions we hear from our clients is: “What should I do when my loan comes due, with less than 10 years remaining on my lease? Can I secure competitive long-term fixed-rate financing?”

In many cases, when a lease term has burned off below 10 years, the availability of competitive long-term fixed-rate financing diminishes. If financing is too unfavorable (or unavailable), owners may opt to sell the property, but then they are faced with buyers expecting higher returns (thus higher cap rates), which drops the property’s market value. Today, this problem is further compounded if the tenant has been forced to close operations or has requested rent concessions, due to the COVID pandemic. Lenders that are willing to finance these properties often require recourse, provide lower leverage or shorter amortization, and/or may require reserves or cash flow sweeps, in order to get comfortable with the short duration of the lease.

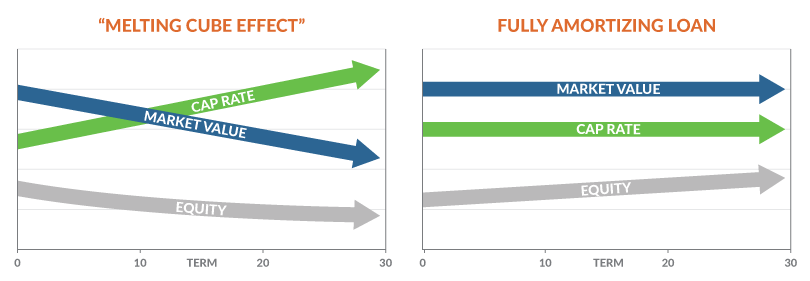

We at Slatt Capital refer to this phenomenon as the “melting cube.” Regardless of how well-located or strong your single-tenant investment is, the remaining amount of time left on the lease directly impacts the property value and your ability to secure competitive long-term financing. As each lease year melts away, it becomes harder to secure longer-term competitive debt. Some tenant leases may offer rental increases and other conditions to provide added value to your investment, but most single-tenant leases tend to be flat or have nominal rent increases over the course of the primary term, and often have challenges countering the negative impact of a shorter-term lease.

Fully amortized financing is one of the best ways to insulate against this common problem. There are many competitive lenders who provide fixed-rate fully amortizing loans from 10-30 years, depending on the credit, lease term, and quality of the asset.

Insurance company lenders thrive in this space, as they have the ability to provide long- term fixed-rate products that match the duration of a tenant’s lease. In most cases, the lender does require the borrower to take a loan that is co-terminus with the lease term. For example, if you have a 20-year lease term, your loan would be fixed for 20 years and fully repaid when the lease expires. This not only eliminates refinance risk but in many cases also creates additional wealth, through the elimination of debt (this type of loan can amortize rapidly). Most fully-amortizing loans tend to be assumable, as well, which can provide additional flexibility for the owner and be a selling point to a potential buyer looking for long-term, low-rate permanent financing.

Whether you intend to sell or refinance, the shorter-term your lease is, the more challenging it may be to execute either strategy. An investor’s goal should be to eliminate challenges as they approach the end of the lease term. Self-liquidating financing is a tool used by single-tenant owners to manage lease maturity and mortgage balloon risk.

Written By:

Andrew MacLeod

Vice President

D: 650.931.9017

andrewm@slatt.com

Connect with Andrew on Linkedin

Michael Kaplan

President

D: 310.954.8207

michaelk@slatt.com

Connect with Michael on Linkedin