The Time is Now – Life Company Financing

The present state of the economy is causing upheaval in the capital markets, just as with previous economic downturns. Concerns over the long-term health of middle-market banks have eroded confidence in the sector, and policymakers are considering important shifts. Bank lending fell in March by measures unseen since 1973, and middle-market banking is transforming.

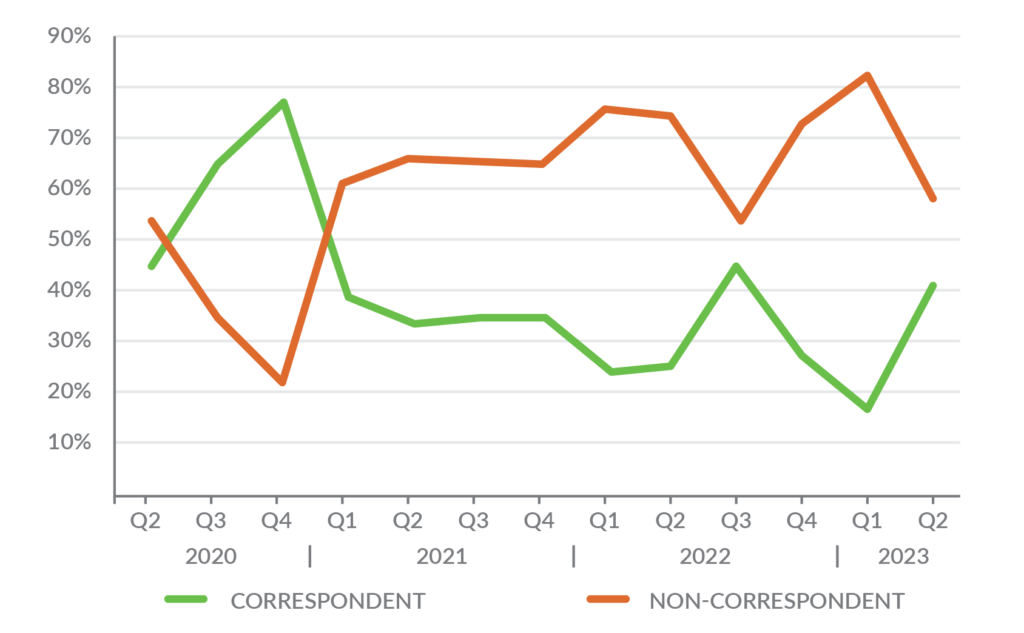

In the commercial real estate regional bank lending space, uncertainty is rife due to depository concerns, corporate bond spread increases, secondary market illiquidity, and other factors. This has caused many middle-market banks to raise their interest rate floors, remove longer fixed-rate products (which are more attractive due to yield curve inversion) or pause lending altogether. Those regional banks that continue to lend are also more prone to shifting attitudes and nervous credit committees, even for their best and most-established customers. As a result, recent loan applications have shifted heavily towards life company correspondent lenders, and we expect this trend to continue.

Lender allocations for 2023 across the board remain largely untapped as commercial real estate lending has come off the banner lending years of 2021 and 2022. The regional banks’ recent slowing has left a gaping hole of demand to be filled with highly reliable lending. More than any other time in this cycle, we believe the time is ripe for Life Company financing to gain back some of the ground they lost in the last few years.

The Basics

Why do life insurers lend on commercial real estate (CRE)? The simplest answer is that they invest in nearly all kinds of investments, including stocks, bonds, asset-based lending such as vehicles, and mortgages secured by residential properties, farms, and commercial real estate of all stripes. CRE loans have some key features that fit very well with life insurance policies:

- Secured – loan is collateralized by real property

- Cash-flowing – most CRE is income-producing from tenants

- Longer-dated – CRE leases can be 3-30 years in length and CRE investors tend to be investors in the space for the long-haul

- Diversified – CRE lending allows arms-length exposure to apartments, warehouses, retailers, office buildings, and many more active parts of the economy simultaneously

Consider a simplified summary of their balance sheets: Current Assets, besides held cash, include regular monthly cash-flows from insurance policy premiums, while Current Liabilities include future policy payouts in the form of death benefits. Often such payouts occur on very long time schedules; instead of a matter of days/weeks/months, it’s on years or decades before a death benefit payout will occur.

As a consequence, life insurance companies and pension funds invest in longer-dated investments with stable, predicable cash flows, with a strong preference for investments that have similar maturities to their liability. Because life companies continue to receive regular cash flow in the form of monthly premiums on their policies, the question is not “if” they’ll continue to invest but rather “how much” they’ll invest.

Compare this to the business model of most banks, which is to lend against deposits or borrow from the Federal Reserve and lend those funds to make a spread over their cost of funds. With the run-up to the current Fed Funds rate and concerns over short-term deposit health along with additional regulatory and political scrutiny, many banks will be leery to lean-in on lending right now even for their better depository customers. Banks use a “cost of capital” model of lending, whereas the life companies utilize what we term an “opportunity cost of capital”; is a life company’s capital better deployed in CRE lending or in other similarly risk-adjusted investments?

When interest-rate risk is a concern, lenders who cannot predict their cost of capital are less willing to grant rate-lock mechanisms, forcing borrowers to bear all of the risk. However, life company lenders excel in this area, offering certainty of execution and rate locks ranging from 75 days up to forward locks of 12 months.

Risk-Based Capital

Life company lenders utilize the “Risk Based Capital” (RBC) framework established by the NAIC to underwrite and categorize investments. Through this approach, they attempt to quantify a potential investment’s risk in real terms. For instance, the most recent RBC CM1 underwriting suggests a 1.50x Debt Cover Ratio (DCR) on a 25-year amortization schedule (300 months), while CM2 indicates a DCR greater than 1.15x. While these metrics may seem conservative, particularly in a rising rate environment, it’s worth noting that, for the most part, if a potential investment satisfies CM1 or CM2 underwriting, it will be funded by someone. This is a marked difference compared to other lender classes. Since the risk is quantifiable, life company lenders are less prone to sentiment swings in credit committees due to nervousness, volatility, or regulation. As long as the credit risk is quantifiably reasonable, they continue lending.

Untapped Allocations

The commercial real estate lending markets in 2021 and 2022 were record years for most market participants. According to the Mortgage Bankers Association, the industry funded over $891 billion in new originations, with 2022 origination slightly lower at approximately $804 billion. While many capital markets participants set their annual investment allocations based on the expected continuation of these numbers, even in light of higher year-end interest rates, the recent MBA Commercial Real Estate Finance (CREF) Forecast projects a decrease to $684 billion in 2023, a 15% drop. If our informal survey of many market participants and production numbers continue through the end of the year, it is likely that the $684 billion number is overly optimistic. Regardless, it is clear that many life company lenders are not meeting their stated allocations, and we anticipate an increase in activity in the latter half of this year. They have more dry powder available to invest than in recent memory but fewer investment options.

Wrap up

In summary, given the challenges facing competing capital sources, the market will place an increasing premium on certainty of execution, and with ample capital to deploy, we believe that life insurance company lenders are well-positioned to provide liquidity to the commercial real estate market, even as some sources such as regional banks may slow down.

Cody Charfauros

Principal / Managing Director

D: 858.257.2110

codyc@slatt.com

Sources:

MBA 2023 RBC Update – https://www.mba.org/docs/default-source/cmf-policy/cmf-issue-briefs/cmf_pol_life_company_rbc_issue_brief_spring22.pdf?sfvrsn=50d84319_2

NAIC Risk Based Capital – https://content.naic.org/sites/default/files/legacy/documents/committees_e_capad_lrbc_final_instructions.pdf

CREFC IRP Guidelines – https://www.crefc.org/cre/content/learn/irp/archives/crefc-irp-8-0.aspx

NAIC The Impact of Rising Rates on U.S. Insurer Investments https://content.naic.org/sites/default/files/capital-markets-special-reports-impact-of-rising-rates.pdf

NAIC Capital Markets Primer on Commercial Real Estate Loans

https://content.naic.org/sites/default/files/capital-markets-primer-commercial-mortgage-loans.pdf