A Rising Treasury Tide Lifts All Floor Rates?

To say things in single-tenant net lease (STNL) financing are crazy right now would be a bit of an understatement. The never-ending yo-yo in treasury rate has lenders scrambling—but not every lender is reacting the same way. Some are making knee-jerk reactions, some are business as usual, while others are content sitting on the sideline to wait for the dust to settle. This type of market can have you pulling out your hair unless you’re up to speed on this quickly changing landscape.

Here’s an overview of what we’re seeing in today’s market:

- Floor Rates – To The Moon!

-

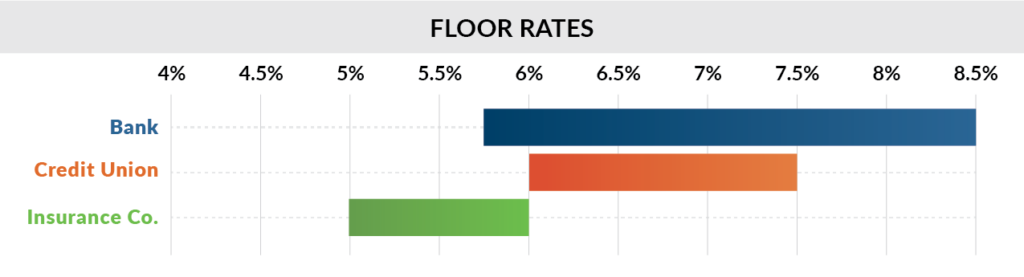

- The vast majority of Banks, Credit Unions, and Life Insurance Companies are setting (and likely increasing) their interest rate floor on new financing requests. Some lenders have made gradual increases in the 20-30 basis point range while others have completely taken themselves out of competitive pricing by imposing 7.00% and even 8.00%+ floors (on requests that would price in the 5-6% range just a few months ago).

- Are lenders doing this as just a knee-jerk reaction to changing rates? Or are they artificially decreasing their pipelines to wait for the market to settle? The real answer is unclear but it means it’s more important than ever to look at each request on a lender-by-lender basis since every lender seems to be doing something different these days.

- Deposits – Lenders Want More (and Some Are Requiring)

- It’s common to see lenders offer rate discounts to borrowers willing to move over large deposits and many are still offering these options today. But almost every Bank or Credit Union you speak with is stressing their need to build their deposits and getting pressure to get them. Asking 10-20% of the loan amount is becoming a common trend and some outliers even ask for up to 50% for deposits (that’s not a typo, imagine taking a $5,000,000 loan and having to move $2,500,000 in cash to your new lender).

- Luckily this is not an industry-wide trend as Life Insurance Companies and CMBS lenders don’t care about deposits (they do care about your liquidity but that’s another topic) whereas Banks and Credit Unions rely solely on deposit levels for their lending power.

- Tighter Credit & Fewer Lending Options

- Lenders are getting pickier on every aspect of underwriting. Preferring core markets over secondary and tertiary locations, higher quality building class, stable property performance, less vacancy, borrower strength, experience, and liquidity… everything that was important before is even more important today.

- Many Banks, Credit Unions, and CMBS lenders have pulled back on long-term fixed-rate products, meaning normally plentiful 10-year fixed loans and 30-year amortizations are getting harder and harder to find. Many are solely focused on 5-year products with the exception of Life Insurance Companies which are still offering 10-, 15-, 20-, and even 25-year fixed products.

The bottom line—don’t assume it’s “business as usual” with all lenders. Make sure you thoroughly cover the entire CRE financing market when you’re in need of financing. Having an experienced advisor on your side may end up saving you more than just time and money on your next deal, they may help save some of your sanity too.

Andrew MacLeod

Vice President

D: 650.931.9017

andrewm@slatt.com